The end of an era? Looks that way to me.

When Apple announced, two years ago, that it would no longer attend Macworld Expo, lots of people said the announcement was Macworld Expo’s death knell. Like some other people, I thought that opinion was a both harsh and premature.

I don’t think that anymore.

On Friday, I did a presentation as a member of the Macworld Expo Conference faculty for the first time in at least eight years. I used to speak at Macworld Expo all the time, having at least one session in San Francisco and Boston (and later, New York) and even Toronto from about 1993 through 2002 or so. Back in the early 2000s, IDG took over the show and the conference management changed. They also went off in a new direction that stressed the creative aspects of working with the Mac. I was always more of a productivity person, so I didn’t fit in.

I still went to the show once in a while, but not very often. I came a few years ago, mostly to meet with one of my publishers. But that was it.

Looking back at it, I realize that I was deep in the Mac world at Apple’s first peak in popularity. The shows — especially in San Francisco — were huge. The very biggest shows took up both exhibit halls of Moscone Conference Center. All the big vendors were there — Apple, Microsoft, Adobe, Macromedia, Claris (later FileMaker), Quark — the list goes on and on. The show floor was buzzing all day long. The noise was deafening and there was a pure adrenaline rush on first entering the exhibit hall. And the products introduced! Even my husband talks about innovations like the Video Toaster (which, ironically, I believe ran on an Amiga). I remember all of Apple’s big hardware and software releases and the software demos that were both educational and entertaining. And how could I forget the Boston show where Mac OS 8 went on sale and my first Mac OS Visual QuickStart Guide sold out?

Afterwards, the parties would start. They were amazing affairs — the Exploratorium is a good example; the party sponsors rented the entire facility, leaving us to wander around and play with the exhibits. There was headliner entertainment, too: one year was Chris Isaac at one party and Jefferson Airplane at another. There were cruises and bungee jumps at Boston Harbor. There were full food, open bar parties at the top of the Fairmont in San Francisco. As one of the B+ list speakers/authors (in those days, anyway), I’d party hop with my peers. I remember one year bouncing from one party to the next with Bob Levitus, who always managed to get into all the parties, whether he had tickets or not.

Things change. Apple took a serious downturn. Things looked bad. Then Steve Jobs came back. The original iMac breathed new life into the company. More products followed. I remember seeing hundreds of buses all over San Francisco skinned with images of five colors of iMacs. But despite Apple’s subsequent successes, Macworld Expo was never quite the same. The show began to shrink.

What I saw on the show floor this year was a shock. The show was tiny — by old standards — occupying about half of one floor at the relatively new Moscone West building. At least 80% of the items on display could be classified as accessories — mostly protective or decorative covers — for the iPad and iPhone. There were very few Macintosh items.

Macworld Expo had become iAccessoryworld Expo.

Although most of the folks I spoke to about their thoughts on this matter seemed to agree with me — some more strongly than others — the members of the Macintosh press that I met there were surprisingly upbeat about it. One of them even commented that Microsoft’s support for the show is a good sign. Support for the show? They didn’t even have a booth! Having a party for a chosen few and being one of the sponsors on another party isn’t the kind of support I’d be upbeat about.

If I had travelled to San Francisco for the sole purpose of seeing the show floor — as I know many people did in the past — I would have been sorely disappointed. Disappointed enough to demand my money back. What I wouldn’t be able to get back was the travel time and expense and the three hours of my life spent trying to understand how so many accessory developers could think there was a market for yet another version of an iPad case. Or skin. Or screen protector.

The real value in Macworld Expo was the conference sessions — now more than ever. The conference management assembled a collection of experts — some old timers like me, some younger and newer to Mac OS (and iOS, of course) — and offered a variety of interesting tracks and sessions for Mac, iPhone, and iPad users.

My session about building your iPad for business was relatively well attended — the room was about half full. I received a handful of follow-up questions and a polite round of applause at the conclusion of my talk. Several of the attendees came up to the front of the room to thank me or offer complements. It was like the old days, but on a much smaller scale.

After all, Friday’s room could have held only about 100 people when, in the past, I did sessions that packed a room that seated more than 300.

And the meeting room area at Macworld Expo used to be busier than a high school hallway between classes each time a session let out. Now only a few dozen people meandered about, shuffling from room to room.

At least these people got something worthwhile for their money.

I know these are harsh words and, as a member of the Mac community with a long Macworld Expo history, it’s hard for me to type them. The conference faculty was treated quite well, with generously filled swag bags, a comfortable place to rest between sessions, and both breakfast and lunch every day. The session rooms were relatively well equipped. It’s hard to share negative opinions about Macworld Expo when IDG staff responsible for the conference part of the show treated me well. But if this blog post precludes me from ever speaking again at a Macworld Expo, so be it. I don’t sugar coat anything and I’m certainly not going to sugar coat this.

While I realize that the old days are long gone, I think that if IDG can’t do better than what I experienced this past week in San Francisco, they should throw in the towel on Macworld Expo and concentrate on better ways to share valuable information with Mac OS and iOS users.

We were staying at the

We were staying at the  I thought about how I was neglecting my blog. (This is the first real entry in over a week.) I wished I could write and post something about my trip — the great fish dinner on the first night, one of the other wives getting her luggage lost by the airline and our subsequent shopping spree at Target, the luggage size of our companions who apparently packed for three weeks instead of three days, the great deal I got on a rental car, the surprisingly peppy ride of the Hundai Accent I wound up with. Or maybe the authentic Spanish tapas I enjoyed with my family in Saint Augustine and the huge ice cream sundaes we consumed afterwards. Or the weather, which dipped down to the 20s (F, not C) at night, with a wind that obliterated the wonderful reflections I’d photographed from our room the day we arrived and ruined what might have been a nice walk along the ocean on the last day of our stay. I couldn’t blog about any of this because (1) typing a long document on the iPad’s “keyboard” is likely to result in insanity (2) I didn’t have access to the Internet to post anything.

I thought about how I was neglecting my blog. (This is the first real entry in over a week.) I wished I could write and post something about my trip — the great fish dinner on the first night, one of the other wives getting her luggage lost by the airline and our subsequent shopping spree at Target, the luggage size of our companions who apparently packed for three weeks instead of three days, the great deal I got on a rental car, the surprisingly peppy ride of the Hundai Accent I wound up with. Or maybe the authentic Spanish tapas I enjoyed with my family in Saint Augustine and the huge ice cream sundaes we consumed afterwards. Or the weather, which dipped down to the 20s (F, not C) at night, with a wind that obliterated the wonderful reflections I’d photographed from our room the day we arrived and ruined what might have been a nice walk along the ocean on the last day of our stay. I couldn’t blog about any of this because (1) typing a long document on the iPad’s “keyboard” is likely to result in insanity (2) I didn’t have access to the Internet to post anything. With all this in mind, it’s pretty clear to me that I should have brought along the laptop. With it, I could have used my phone to get online. I could have blogged daily. I could have kept up-to-date with tweets. I could have realized that the weather would turn sour and those wonderful reflections on the pond outside the hotel would be gone the next day, giving me no second chance to photograph them properly.

With all this in mind, it’s pretty clear to me that I should have brought along the laptop. With it, I could have used my phone to get online. I could have blogged daily. I could have kept up-to-date with tweets. I could have realized that the weather would turn sour and those wonderful reflections on the pond outside the hotel would be gone the next day, giving me no second chance to photograph them properly.

Here’s how it works.

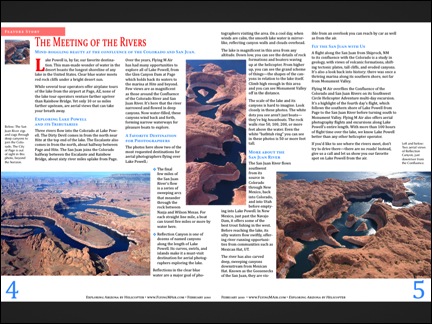

Here’s how it works. Tap a downloaded magazine to read it. In portrait mode, it appears as a single page. In landscape mode, it appears as a spread. You can pinch and drag to magnify and scroll.

Tap a downloaded magazine to read it. In portrait mode, it appears as a single page. In landscape mode, it appears as a spread. You can pinch and drag to magnify and scroll.