Why I love my life — and how you can love your life, too.

I love my life.

That’s the thought that struck me last Saturday afternoon, as I walked across the transient parking area at Lake Havasu Municipal Airport, from the FBO office to my helicopter, swinging a plastic bag full of BBQ takeout.

I love my life.

The sudden thought amazed and exhilarated me. It put a skip to my step and made me smile.

I love my life.

This was near the end of a busy day when I’d spent 2-1/2 hours flying an aerial photographer and videographer over six different target vehicles in the 2013 Parker 250 off-road race. It had been hard, challenging flying, sometimes dangerously close to the ground, performing maneuvers that pushed the helicopter’s capabilities as much as — if not more than — I’d ever pushed them before.

This was the same day I’d been up at 5 AM and had gone out with just a half a cup of coffee and some oatmeal in my belly on a 31°F morning. The same day I’d preflighted my helicopter and pulled off its doors in the predawn gloom with just a Mini Maglite to light the way.

This was the day after I’d spent the night in a houseful of strangers — all men — sleeping in a bed on sheets that someone else had slept in the night before.

And it was only 24 hours — almost to the minute — after being offered the aerial photo gig 80 miles across the desert from my home.

It had been a most unusual and challenging 24 hours.

And I had enjoyed every minute of it.

I love my life.

I realized, as I walked across the airport ramp, smelling the aroma of my BBQ dinner and looking forward to the fried okra I’d nibble in flight on the way home, that I needed to blog about this sudden realization, I needed to document how and why I felt the way I did. I needed to capture the moment in my blog to remember it forever, just in case the feeling should fade due to events in the days or weeks or months to come. I needed to share it with others who may also love their lives but not really know it. And to share it with the folks who are missing the point of life — the meaning of life, if you will — in an effort to help them understand and set a course that would enable them to love their lives, too.

What I Love about My Life

In thinking hard about this, I think what I love most about my life can be broken down into several things: freedom, time, variety, travel, challenge, and friends. Bear with me while I address how each of these affect my life and personal philosophy.

Freedom.

Because I don’t have a “regular job” and I don’t have kids or a husband to answer to, I have the freedom to do pretty much whatever I want. If I feel like getting up at dawn to photograph first light over the desert, fine. If I feel like eating leftover Chinese food for breakfast, great! If I feel like hopping in the car with my dog and spending the night in Prescott after a pot-luck dinner with friends there, wonderful! Anything goes. My only limits are time (see below) and money.

Time.

Not having a “regular job,” kids, or a husband also means I can make my own hours and do things when I want to do them. Obviously I’m not completely free — I still have work to do and appointments to keep — but my time is extraordinarily flexible. For the most part, I make up my day and week and month as I go along. If something I’m doing needs more time, I take it. The only time of year when my time (and freedom) are restricted is when I’m on contract for agricultural work — but that’s only 11 weeks out of the year. (I don’t know too many people who would find that a hardship.)

Variety.

Back in 1987 (or thereabouts), I took a job as an auditor with a large residential developer. I did construction project audits. Every single audit took about two weeks to complete and was exactly the same. After two months, I started looking for another job. The lack of variety in my work was driving me insane.

I feel the same today — I thrive on variety. I like the fact that every day of my life is different. I wake up at different times, I do different things, I see different people, I eat different things, I go to different places, I go to bed at different times. Unless I’m elbow-deep in a book project that consumes 10 hours a day, no two days are the same. And that’s very nice.

Travel.

One of the benefits of time and freedom is the ability to travel. I love to travel, to get out and see different places. When things get dull — when I feel as if I’m slipping into a rut at home — I shake things up with a trip. I’ve been home in Arizona since September and have managed to take at least one trip every single month since I’ve been back: Washington (twice), Las Vegas, California, Florida, and Lake Powell (by helicopter). That doesn’t count the day trips and overnight trips I’ve squeezed in on a whim: Prescott, Phoenix, Winslow, Parker, and Tucson. And I already have my next three trips planned out.

I don’t travel as a tourist, ticking off items on a list of things to see. I travel to experience the places like someone who lives there. It’s a much better (and usually cheaper) way to experience the world.

Challenge.

What can I say about challenge? Simply put, a life without challenges is simply not a life worth living. I need goals — realistic and achievable goals — and I need to be able to work toward them.

My entire life has been a series of challenges and achievements, some minor, like learning to ride a motorcycle or horse, and some major, like building a successful career as a freelance writer or building a profitable helicopter charter business from the ground up. I’ve always got a handful of goals in my back pocket and am always working toward achieving the ones that mean most to me at the moment.

I’m fortunate to have a good brain and good work ethic — two prerequisites for success. I’m also fortunate to have good health, which makes everything else a lot easier. But I know plenty of people who have all these things and still don’t challenge themselves. They skate through life, doing the least they can do to get by comfortably, never challenging themselves to go the next step. I simply couldn’t live like that.

The best part of always having challenges and goals to work toward? I never get bored.

Friends.

It wasn’t until this year, when my marriage fell apart, that I realized how much my friends mean to me.

When I was married, living with my husband in Wickenburg or Phoenix, I didn’t have many good friends. I couldn’t. There was no room in my life to build and maintain friendships.

But when I went away to Washington for my summer work, my husband stayed behind. I began building strong friendships with some of the people I met. I also kept in touch with other friends from all over the world by phone, email, Twitter, and Facebook. This network of friends was amazingly helpful and supportive when my husband called me on my birthday in June and asked for a divorce. And they were even more supportive when I discovered, in August, the lies and the woman he’d been sleeping with. The pain of his betrayal is sharp, but my friends help ease that pain.

Even now that I’m home, dealing with harassment from my husband or his lawyer on an almost weekly basis, my friends have been extremely helpful, showering me with invitations to get out and do things together, offering me their homes as destinations for trips, or simply sharing words of encouragement and support. They not only take the edge off my divorce ordeal, but give me a great outlook on life.

Without good friends, no one can truly love their life.

How I Got Here

I got where I am the way most people get where they are in life — but with an abrupt turn and an important realization along the way.

The abrupt turn: career change

Raised in a lower middle class family, divorced parents, stepdad that brought us all up a notch and offered my family the financial security we never really had. High school, college. 9 to 5 job with a good employer and good benefits. A new job that wasn’t a good match (see above) followed by a better job with a Fortune 100 corporation. Things seemed pretty sunny for me.

But they weren’t. I wasn’t happy. I didn’t like the work I was doing. I didn’t like the way the hour-long commute — each way — was eating away at my life. I didn’t like corporate politics and game-playing. I was good at my job, I made good money, I kept getting raises and promotions, but I dreaded getting up in the morning.

Been there? I bet you have. Many people have.

Trouble was, I made a bad decision back in my college days. I always wanted to be a writer, but I was convinced by my family that I needed a better career path. I was the first in the history of my family to go to college, so it was a big deal. I was good with numbers and math so we figured accounting was a good course of study. I ended up with two scholarships in a great business school, Hofstra University on Long Island. But in my junior year, at the age of 19 — did I mention I started college at 17? –I began realizing that I really didn’t want to be an accountant. I wanted to be a writer. I called home and told my mother I wanted to change my major to journalism. She had a fit and told me I was crazy. That I’d never get a job. That I’d be giving up a great future. I listened to her. I was 20 when I got my BBA degree with “highest honors” in accounting.

I’ve always regretted listening to my mother that day. Indeed, that was the last time I took her advice on any important life decision.

I always wrote — I kept journals and wrote novels and short stories that were never published or seen by others. And I always remembered my dream of becoming a writer. So in 1990, when the Institute of Internal Auditors was looking for someone to author a 4-1/2 day course about using “microcomputers” (primarily 20-pound “laptops”) for auditing and there was a $10,500 price tag attached to it, I sent them a proposal and got the project. I asked my boss for a leave of absence to do the work but was turned down. So I quit.

And that’s when I began my freelance career.

Believe me, leaving a job that paid me $45K/year plus benefits (in 1990) at the age of 28 was not an easy decision. As you might imagine, my mother absolutely freaked out.

Looking back at it now, this abrupt turn in my career path marks the day I stopped skating through life and started challenging myself to do better.

And I did. I had some rough patches along the way — the first full year freelancing was pretty tough — but I worked hard and smart and picked up momentum, mostly by working multiple jobs as a per diem contractor while writing articles and books. By 1998 I had my first best-selling computer book; the second came the following year. By then, money was not a problem — I finally made more money than I needed to live comfortably. I saved, I invested, I put money away for retirement.

And I used my excess time and money to challenge myself again: to learn how to fly helicopters.

By 2001, I’d bought my first helicopter and was trying to start a business with it. In 2005, I took that to the next level with a new, larger helicopter and FAA Part 135 certificate. In 2008, I found the niche market — agricultural work in Washington State — that finally enabled me to turn a profit. As publishing began its death spiral, I was already prepared with a third career that could support me.

People say I’m lucky. I disagree. The only thing I’m lucky about is having a good brain and good health — and even that’s something that I work at. It’s my work ethic — my deep-rooted philosophy that the only way to get ahead is to work hard and smart — that made everything possible. I truly believe that if you have a reasonable goal and you work hard and smart, you can achieve it.

Being able to make a living doing what I really love to do — writing and flying helicopters — makes it possible for me to love my life.

The important realization: the meaning of life

On my journey through life, I also made an important realization that changed everything: I discovered the meaning of life.

No, it isn’t 42.

As far as I’m concerned, there is no meaning to life. Life just is. But there are some undeniable facts about life and careful consideration of those facts should guide you to get the most of your life.

I guess I can sum it up my realizations about this in a few bullet points:

- Life is short — and your life might be even shorter than you expect.

- You only have one life. (I don’t believe in an “afterlife” or something like reincarnation.)

- You should live your life as if you’re going to die tomorrow. That means not putting off until tomorrow what you can do today. It also means skipping the “bucket list” and doing what you want as soon as you can. And, by simple logic, it also means not waiting until you reach retirement age to start doing all the things you’ve wanted to do. You might never reach that age.

I think the light bulb came on back in 2008. When my friend Erik got sick and died unexpectedly at age 56, I realized that life can be taken from you at any time. I decided that I wanted to live life now — not when I turned the standard retirement age of 65. I realized that I never wanted to retire — that I wanted to do some kind of income producing work for the rest of my life. But I also knew that I didn’t want to be a slave to my work, now or ever.

I realized that in order to really enjoy life, I had to ensure my current and future financial security. That meant shedding assets I didn’t need and the debt that went with them. That meant paying off debt on important assets I’d always need, like a roof over my head. That meant building my business while paying off debt on its assets so that the business could support me without taking over my life.

And I’ve done all that. My house was paid off last February; I made the last payment on my helicopter earlier this month. I haven’t bought a new car since 2003 so I have no car loans or personal loans. Everything I buy now is by cash or credit card and, if by credit card, it’s paid off in full at the end of the billing cycle. I live within my means. I have no debt.

Do you know how cheaply you can live when you’ve got a paid-for roof over your head and no debt?

Go back to my discussions above about freedom and time. I mentioned that I don’t have a “regular job.” I’m proud of that fact. I worked hard to become debt free so I’d never have to get a regular job. Being debt-free gives me time and freedom.

Being debt-free makes it possible for me to love my life.

Don’t Get Me Wrong — My Life is Not Perfect

I don’t want you to come away from this blog post thinking that my life is perfect and that nothing ever goes wrong. That’s simply not true. My life might be good and I might love it, but it’s far from perfect. It’s worth taking a look at what’s not quite right.

Personal failures

I mentioned above that I need challenge to enjoy life. You might think that I always succeed at what I try. The truth is, although I have a pretty good track record, I don’t always succeed in what I set out to do. Sometimes it’s my fault, sometimes it’s the fault of others I trusted or relied on — which is ultimately my fault for trusting or relying on them. Sometimes it’s just the fact that what I was trying to achieve wasn’t really possible for me to achieve.

One example is my stint as a landlord. Back when I starting making good money, I started investing in rental properties. At one point, I owned a condo, a house, and a 4-unit apartment building. The idea was to run these as a business that generated enough revenue to pay the mortgages and possibly a little extra. But try as I might, I simply could not succeed in keeping the units full with tenants who paid the rent on time and respected my property or their neighbors. There was never enough revenue to cover all the expenses. There were headaches with complaints and repairs and cleanup. It was a miserable ordeal that I hated. I wound up selling my properties before the housing market tanked. One of them resulted in enough of a profit to put a healthy down payment on my second helicopter, so I guess I can’t complain. But as a landlord, I was a complete and utter failure.

Then there were the aerial video projects I attempted back in 2008. I hooked up with a video production company based in the San Diego area. I’d worked with the owner and liked his work. He came up with a proposal and I signed up, giving him a chunk of money. I then spent at least another $10K on flying and related expenses to gather footage. And paid another chunk of money for him to start turning it into something. Then I saw the footage and what he was trying to pass off as a “trailer.” I realized that he was simply not capable of creating the products he had contracted with me to produce. I threw another $2500 at a lawyer, trying to get some of my money back, but the video guy was unreachable and I soon got tired of throwing good money after bad. Finally tally of money lost: about $40K. Ouch. That was an expensive lesson.

I’ve also had failures getting contracts for book ideas and books that simply didn’t sell very well. I’ve failed to get certain writing or flying or web creation jobs I wanted. I’ve made bad (or at least regrettable) decisions on purchases of RVs, vehicles, and property. I’ve trusted people I shouldn’t have trusted and said things I shouldn’t have said. I’ve dropped the ball when it was my turn to play it, thus making a successful outcome impossible. And I’ve even let other people down when they expected or needed my help. I’m not proud of any of these things, but I can’t pretend they didn’t happen.

There are two things I need to say about personal failures and bad decisions:

- There’s no reward without risk. If you don’t take chances, you will never achieve anything. This all goes back to the idea of skating through life. People who skate do so on a flat surface, never moving up or down. Nothing ventured, nothing gained (or lost). People who take risks can either climb or fall — by taking measured risks and putting the right effort into achieving goals, they’re more likely to climb.

- We must all take personal responsibility for our own decisions and their outcomes. While others might advise you based on their own experiences or agendas, it’s up to you to make the final decision. Once made, you must take and keep ownership of the decision. Yes, I’ve made some bad decisions in my life that have led to disappointment or failure, but I alone am responsible for them. And I can live with that.

Life partner

And that brings up the second big thing that’s not perfect in my life: I don’t have a life partner.

I did — or I thought I did — for 29 years. We met in 1983 and hit it off almost immediately. We began living together only six months after we met. He liked to use the word “partner” to describe our relationship, but the partnership began to get tenuous not long after we got married 6 years ago.

It took me a long time to realize this. For years I think we were life partners, a real team that shared the same interests, dreams, and goals. But as time went on, that changed. The man who had been my leader became my follower and then my ball and chain. It happened slowly over time — so slowly that I didn’t even realize it was happening. And even when I began to realize it, I couldn’t believe it and remained in denial. I loved him too much. I didn’t want to believe it. Even today I’m having trouble believing that the man I’m in the process of divorcing is the same man I fell in love with and began sharing my life with 29 years ago.

I think part of the change had to do with our outlook on the future. Where I wanted to shed unneeded financial burdens to gain freedom and live my life now, my husband didn’t share either goal or philosophy. His purchase of a second home in Phoenix put a huge financial burden on him, but he refused to sell it. (And I won’t even go into how his living there with a roommate four days every week drove a wedge between us.) His worries about saving up for retirement and paying his bills put him in a string of dead-end jobs with employers who didn’t appreciate his skill set or compensate him properly. He’d become a slave, working primarily to satisfy his huge financial responsibilities and refusing to take steps to improve his situation. He was frustrated and miserable — and, in hindsight, probably jealous of my freedom. He took it out on me, with a never-ending string of put-downs and arguments and “the silent treatment” that wore away at my self-esteem and made me bitter and angry.

Even after visiting a marriage counselor (at his request), when I went back to Washington for my summer work last May, he immediately began to look for my replacement. He found one on a dating website: a typical desperate, middle-aged woman who would do or say (or share photos of) almost anything to snare a man who could ensure her financial future in exchange for sex and ego-stroking. His birthday call to me included the announcement that he wanted a divorce and a series of lies I honestly didn’t think he was capable of.

The transformation of life partner to vindictive and hateful enemy was complete.

And while the pain of his betrayal is probably — hopefully — the worst pain I’ll experience in my life, it does free me from the only thing still preventing me from loving my life: him.

But it also leaves a void in my life, an empty space I thought I had filled. While I enjoy my life, I think I would enjoy it even more if I could share it with someone. Still, I know I’ll be very careful about who I invite to share it with me; I’d rather go through the rest of my life alone than to trust and rely on the wrong man.

Been there, done that. Ouch.

I Love My Life

But as I walked across the tarmac at Lake Havasu Airport last week, swinging my bag of BBQ takeout, I wasn’t thinking about the things that kept my life from being perfect. Indeed, thoughts of such things never entered my mind. Instead, I felt a surge of happiness — exhilarating and exciting — that overwhelmed me when I suddenly realized that I love my life for what it is.

Sure, I have some rough patches ahead of me. My financial situation will take a bit of a hit when I lose half the house and have no place else to live. But I still have my brains and my good work ethic and my health. And I have the business I worked so hard to build over the past ten years. And I have my imagination to think up new ideas and new challenges. And my willingness to take risks to move forward and up — and accept the consequences of my decisions and actions. And I have all those other things: freedom, time, variety, travel, challenge, and friends.

My life is ahead of me — not behind me. And I embrace it because I love it.

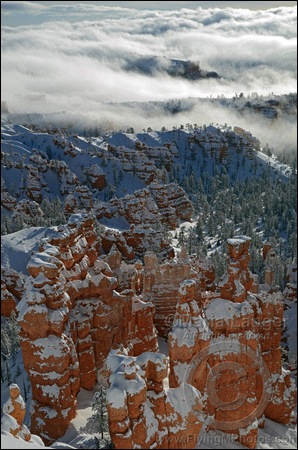

My client steered us to Sunset Point. Two very large snow throwers were at work in the parking area where only two cars were parked. We parked behind one of them, got our gear together, and headed out to the lookout point.

My client steered us to Sunset Point. Two very large snow throwers were at work in the parking area where only two cars were parked. We parked behind one of them, got our gear together, and headed out to the lookout point. The first hint that things might improve came a while later when the sun started breaking through the clouds. I snapped this photo using the HDR function of my iPhone and then fixed it up a bit more in Photoshop to bring out the shadows. Not too impressive. The light faded again right after that and I started thinking about how warm the car might be. But I decided to stick it out a bit longer.

The first hint that things might improve came a while later when the sun started breaking through the clouds. I snapped this photo using the HDR function of my iPhone and then fixed it up a bit more in Photoshop to bring out the shadows. Not too impressive. The light faded again right after that and I started thinking about how warm the car might be. But I decided to stick it out a bit longer.