“Retirement,” which seemed so far off just last year, is now close at hand and remarkably easier than I thought it would be.

John’s Carver at its slip in Charleston, SC, on the night I boarded for our five week trip together.

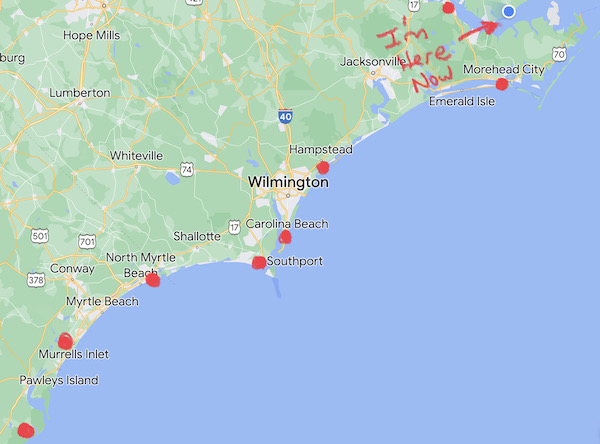

Back in Spring 2022 — just 14 months ago? — I was on a cruise with Capt John on his 36′ Carver Aft Cabin cruiser on a trip up the Intracoastal Waterway (ICW). (You can read more about that in my Great Loop blog.) It was April and I was trying to enjoy the cruise while worrying about a bunch of work-related things back home:

- Cherry season was coming up and I had all the usual concerns about the season. Would the cherry crop be viable? Would all my clients sign up? Would I get back clients who hadn’t signed up last year because of the frost? How much acreage would I have to cover? Would I need pilots in Wenatchee, Quincy, and Mattawa or just Wenatchee and Quincy? Would I be able to find enough pilots?

- My helicopter N7534D, was aging and had just 20 hours left until a required overhaul that would cost $270K. I had already decided to sell it after cherry season, but was 20 hours enough for the season? What would I do if I flew that off?

- Would I be able to sell my Part 135 charter business (which had become a pain in the ass because of the ineptitude and spite of inspectors at the Spokane FSDO) with a nearly timed-out helicopter? Would the guy who kept claiming he wanted to buy it all actually come up with the money?

- Would I be able to find another helicopter to replace it without going back into deep debt? Or should I just retire from cherry drying? Would I be able to sell my cherry drying business to someone else who wanted to take my place?

All this was going through my mind as we cruised at 6 knots up the ICW, spending a few days at stops along the way. To be fair, my cherry season stress normally starts in March and April, but this year it seemed more stressful than usual, mostly because of the age of the helicopter and its upcoming need for an overhaul.

Wonder why I keep putting “retire” and “retirement” in quotes? It’s because my idea of retirement isn’t the same as most people’s.

I’ll never stop working. Whether I write or make jewelry or do odd jobs in the gig economy, I’ll always have something to keep me busy that brings in a few bucks. (Hell, this summer I’m even selling eggs from my chickens at $5 a dozen.) I’d already considered getting my boat captain’s license — yes, for a boat I didn’t even own yet — and doing charter cruises to earn cruising money.

I won’t stop working until either my mind or body makes it impossible. Working keeps us alive; you can ask my wasband about his dad’s short retirement to get an idea of what I mean by that. (I hope you’re resting in peace, Charlie.)

In general, although I had thoughts about retirement, it was still far off on the horizon. I couldn’t imagine being “retired.”

I did, however, have a rough plan for buying my own boat and cruising the Great Loop in it. I’d even looked at boats. But I couldn’t buy a boat unless I sold the helicopter and I still couldn’t buy a boat if I wanted to get another helicopter and stay in the business. So I figured the boat purchase would be sometime in 2024, after that cherry season. Maybe that’s when I’d “retire,” too.

Everything Changes

Everything changed with a phone call. A guy with a lot of money offered me a lot of money for the helicopter if I sold it then. He wasn’t interested in the charter business, but the amount he offered for a helicopter that I was hoping to unload in a few months anyway was too much to ignore. On May 6, I watched it fly away for the last time with the money secured in my bank account.

It was a lot easier to say goodbye to this helicopter when the money was in the bank and my thoughts were on the kind of boat I’d buy to replace it. Also, no more $20K per year insurance bills. Yippee!

I arranged to lease a helicopter for the season. (There were problems with that, but I won’t go into it here.) I got contracts, I got pilots. The season started off good and then fizzled out in mid June when it stopped raining. The season ended in August. I heaved a sigh of relief again.

I listed my charter business with a broker. I knew that I’d have to get a helicopter to keep my Part 135 certificate and I’d decided that I was done owning helicopters. The broker listed it for a lot more than I expected.

Meanwhile, with all that helicopter sales money sitting in the bank, I started shopping for a boat. By the end of August, I’d made a deal on one.

Around that time, the broker found a few buyers for my company. One backed out. The other was an idiot tire-kicker who called me directly with a crazy lowball offer. But the third was serious. As I was signing papers on DocuSign to buy the boat, I was signing other papers on DocuSign to sell my company.

And suddenly, I found myself with a nearly new Ranger Tug, a new company that offered just cherry drying and aerial photo services, and a bunch more money in the bank than I expected to have at the end of cherry season. I’d also shed a costly-to-keep helicopter, a charter business I no longer wanted, and the anxiety of dealing with unreasonable, demanding people at the FAA.

I celebrated by spending September learning to cruise in my new boat. Then I shipped it to Chicago and got it on the Great Loop.

While I’m home this summer, I can be reminded of my first day on the Loop with the new Home Screen on my phone.

I named my boat Do It Now. Frankly, I was done waiting. Hell, I’d been done way back in 2010 but had a husband to shed to move forward. It had taken me 12 years to get through the divorce debacle and become financially secure in my home — which I’d paid off in July 2022 — before I could get back on track for what I wanted out of life.

But I didn’t think that I was one big step closer to “retirement.”

Retirement Thoughts Kick In

It wasn’t until this past winter that I started thinking about the possibility of tapping into the retirement money I’d been saving in earnest since the late 1980s. I own some stock — including Apple stock I originally bought at $13/share in the mid to late 1990s that had grown substantially with numerous splits and stock price increases. And I had some savings. And my living expenses were pretty low since just about everything I owned was completely paid for.

I’d been under the impression that I had to wait until I was 65 to start tapping into my retirement funds. Or maybe it was 62? I asked a knowledgeable friend. No, he told me. 59 1/2 is the age you can start using that money.

Holy cow. I was there.

I had a great winter cruising on the Great Loop in Do It Now, covering 3000+ miles, mostly solo. I made friends, saw a lot of new places, and met challenges along the way. I took a seven-day captain’s license class and passed the test.

But as March and April came along, I had the same cherry season worries as usual, but with a twist: I didn’t have a helicopter to fly. How was I going to deal with that?

Various solutions came about and I explored them all. But it wasn’t until I started contracting with clients that I realized what a non-issue it would all be. One of my clients did not sign up again. Since he accounted for about 2/3 of the acreage I cover, my season would be a lot shorter with fewer pilots and less revenue to pay them. I’d be able to keep a lot less money.

At first, I was angry. But then I reasoned it out. I wanted to to retire at the end of the season anyway. I was hoping to be able to sell the business, but if I had a good enough season, I might talk myself into keeping it and doing it again. But this one client had helped me make two decisions that took a lot of stress out of my life:

- Without the added acreage, the business wasn’t worth selling so I didn’t have to stress over finding a buyer (or dealing with the tire-kicker who claimed 3 years ago that he wanted to buy my whole business).

- With less revenue coming in, it was less attractive to keep doing the work. I was no longer tempted to do it another year. Retirement at the end of the season was a definite.

And I’ll be honest here: the client who had backed out was a pain in the ass anyway. Now I wouldn’t have to deal with his antics.

I was looking at the reality of having a summer off in 2024 for the first time in 25 years. It took no time at all to imagine my trip up to New York that summer for the ultimate Champlain, Erie, and Severn Canal cruise in my boat.

And with that, I had scheduled my retirement: August 2023. I would be 62 years old.

The Money Stuff

The question was, could I afford retirement without changing my lifestyle? I have to admit that cruising in a boat thousands of miles over the course of months is not exactly cheap. If I wasn’t going to make enough cherry drying money this summer to cover the next year of cruising, where would the money come from?

The answer was easy: my retirement funds.

They’d been growing and shrinking and growing and shrinking but mostly growing over the past 30 years. If I continued to earn some income from other sources, I wouldn’t need much every year — probably not even enough to start getting social security anytime soon. After all, other than cruising my cost of living was modest. (It really pays, folks, to eliminate all your debt before you retire.)

I had a talk with my accountant yesterday and a “retirement specialist” at my investment firm today. I discovered that my lowered income would save a lot of money on taxes, get me a better ACA health care subsidy until Medicare kicked in in 2026, and enable me to make retirement plan withdrawals without huge tax hits. I also discovered that tapping into my IRA would be as easy as filling in a form on my investment website. The money would arrive within days as a direct deposit to my bank account.

Of course, the money I’ve invested in my retirement funds is not unlimited. I will eventually run out. How quickly that happens depends on the stock market and how much I take each year. But I still have Social Security waiting for me and can always sell my home on the next market upturn. I think I’ll have enough for the rest of my life.

That is the goal, isn’t it? To die with just enough money to dispose of your body and give your friends a big party to say goodbye?

Facing retirement? Yes, but also embracing retirement. I just didn’t expect it to be this soon.