I become a real homeowner for the second time in my life.

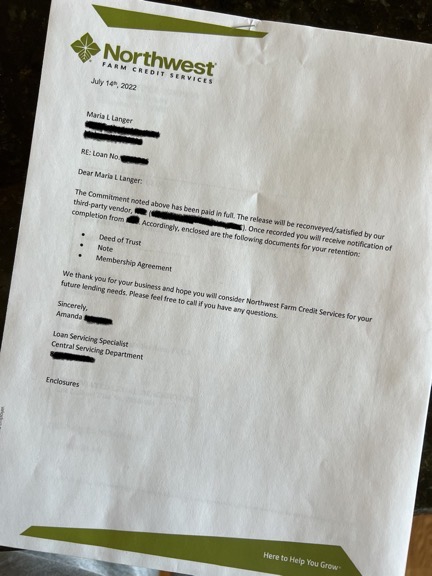

I got this letter in the mail yesterday after making a final lump sum payment on what I’d always thought of as my “mortgage.” (Technically it was a land loan; I never had a mortgage on this home.)

On July 14, 2022, I officially became a mortgage-free home owner for the second time in my life. That’s the date of the letter from my bank confirming that the lump sum payment I’d sent in June had paid off the balance of my land loan.

I bought the land nearly nine years ago, the day after my divorce was finalized. It was a long story and crazy process that you can read about in a blog post I wrote about it. It wasn’t a cheap lot, but the view from those 10 acres made it worth every penny. I’m generally a debt-adverse person, so I put 50% down on it and borrowed the rest. The owner financed until I could get my paperwork in order and get a loan about a year later with Northwest Farm Credit, a company that specializes in farm loans. My lot, zoned Rural Residential, met the criteria for lending. The terms were a fixed rate for the first 7 years, adjustable annually after that, with a balloon payment at the end of 10 years.

Amortization was based on 30 years, keeping the monthly payments low; for the first 7 years, my monthly payments were just $501. I kicked in an extra $500 toward the principal every month for at least 3/4 of the months over those 7 years. The goal was to pay down the principal quickly so I wouldn’t get hit with the kind of huge balloon payment the bank estimated. When the first interest rate adjustment came, my monthly payment dropped to less than $300/month. I honestly don’t know the exact amount because I kept paying the $1001/month that I’d been paying. Now I was kicking in more than $700/month to principal only.

With my June birthday coming up, I noticed that I owed less than $12K for the property. Rather than let my regular payments pay it off in just under one more year, I decided to make the payoff a birthday present for myself. So I wrote a big check, got a $14.90 refund for my overpayment, and received the letter saying the loan was paid off.

I’m a mortgage-free home owner.

The Money Stuff

Now if all this is gibberish to you and you’ve got one of those 30-year mortgages on your place, you might want to chat with an accountant or financial advisor about the possible benefit of paying extra toward the principal on that mortgage.

I remember my first mortgage with my future wasband. It was a 30-year term because that’s all we could afford when we bought our first home. We paid what was due — on average about $1200/month — every month for 11 years. When we sold after 11 years, we’d only contributed about $16K toward the principal — that’s after paying over $158K. Where had all that extra money gone? Mortgage interest, of course. Rates were a lot higher then, but still! We had a house but very little equity in it.

I think that experience is what woke me up to the realities of mortgages and home ownership. If you have a large loan and pay it over a long period of time, you’re likely to pay a lot of money in interest without increasing your equity in the home by very much. In that case, what’s the benefit of buying over renting? When you own a home, you’re responsible maintaining and repairing it. When you rent, you’re not. And when you’re paying 90% of your monthly mortgage payment toward interest instead of principal, it’s like paying rent without the benefit of a landlord to take care of the home.

Home ownership remains a goal of many people. It’s a great goal, but it’s not achievable unless you are able to maximize your downpayment, minimize your loan term, and pay down the principal as quickly as possible. Otherwise, you’re basically paying rent to a bank with the added expense of home maintenance, repairs, and property taxes.

When my future wasband and I sold that first home and moved to a new home in Arizona, we quickly refinanced to a 15-year loan term. Sure, the payments were bigger, but each payment applied more money to the loan principal. And with the lesson learned from our first home, I (the debt-adverse person in charge of household finances) would send additional principal payments for the loan to the bank a few times a year, when there was some spare cash in the household account. By doing so, we managed to pay off the loan in just over 11 years.

And that was the first time in my life that I was a mortgage-free home owner, at the age of 50 — although I was just half owner on that particular property.

My House

My house, of course, has been paid off since it was built. Because of the construction style of my home — post and beam construction — a building loan was not possible to get. So I had to pay cash as it was built.

Yeah, that was a challenge. Fortunately, my decent income and low cost of living rose to that challenge. I was living in my 36-foot fifth wheel, the “Mobile Mansion,” on my property at the time so there was no rent to pay and that likely saved a ton of money that could go toward construction.

I had the house built in stages starting on May 20, 2014: first the building shell and then the living space upstairs. I did a lot of the interior work myself: electricity, flooring (wood laminate and tile), and deck rails/floor. I subcontracted out to a framer and plumber and insulation/drywall/painting guys. I designed a custom kitchen with granite countertops at Home Depot and let their guys install it all. I bought my appliances at a Black Friday sale and, again, let them install. The place came together bit by bit over the course of two years. I wrote a lot of checks. But in the end, it was done and it was paid for.

The Great Room in my home. I really do love it here.

The Lecture

I know that what I’ve achieved is beyond the means of many people. I don’t want to say I’m “lucky” that I could do this because I truly believe that we make (most of) our luck. (And besides, I’ve had a bit of bad luck, too.) I’m not rich, but I do know how to work for a living and manage my money.

Living within my means is step 1 — and that’s the step most folks can’t seem to manage. They buy things they don’t need or can’t afford, relying on credit cards and loans to make it happen. Soon, every penny from every paycheck is spoken for and still some of them keep buying. They live in a world of never-ending debt by making minimum payments on every debt they owe. And then they complain that they’re broke.

That’s not me. I learned my lesson about debt TWICE when I was in my twenties. The second time did the charm. Years later, I realized that the first step to financial security — especially in retirement years — is having a paid-for roof over your head. That’s what motivated me to get the house I owned with my wasband paid for. And that has definitely been on my mind over the past 10 years as I get ever closer to retirement age.

I’m 61 now and starting to think seriously about life in retirement. Getting that paid-for roof over my head was a good start on the things I need to do to achieve my retirement dreams.

The house was one of the very first built in our area. It’s a one-story structure with just two bedrooms and two baths, perched on a rocky, lichen-covered outcropping. At the base of the rocks was a densely vegetated flood zone, filled with local trees and bushes slightly higher than the level of Cemetery Wash, which also flows through our property. Up at house level were irrigated trees so mature that they blended in perfectly with the home. The house seemed to be part of the landscape. And in the morning, when the first light of day hit it from the east, it glowed red, as shown in this July 2007 photo.

The house was one of the very first built in our area. It’s a one-story structure with just two bedrooms and two baths, perched on a rocky, lichen-covered outcropping. At the base of the rocks was a densely vegetated flood zone, filled with local trees and bushes slightly higher than the level of Cemetery Wash, which also flows through our property. Up at house level were irrigated trees so mature that they blended in perfectly with the home. The house seemed to be part of the landscape. And in the morning, when the first light of day hit it from the east, it glowed red, as shown in this July 2007 photo. Monsoon season came and the first heavy rain brought a massive flash flood. The sand berms were no match for the power of flowing water. The water coming down the wash was no longer held back by the dense vegetation that had grown below the house. The wash changed its course, flooding the undeveloped “pasture” and cutting across the bottom of our access road. The rushing water completely flooded the sandy area in our part of the flood plain and, for the first time ever, our entire fence was washed away.

Monsoon season came and the first heavy rain brought a massive flash flood. The sand berms were no match for the power of flowing water. The water coming down the wash was no longer held back by the dense vegetation that had grown below the house. The wash changed its course, flooding the undeveloped “pasture” and cutting across the bottom of our access road. The rushing water completely flooded the sandy area in our part of the flood plain and, for the first time ever, our entire fence was washed away. When the water subsided, parts of our neighbor’s new fence were tangled across the access road to our neighbor’s house. Cinderblocks from their corral area littered our lower horse corral. Their “pasture” was filled with sand. Lucky they hadn’t set up the irrigation yet; it would have been destroyed.

When the water subsided, parts of our neighbor’s new fence were tangled across the access road to our neighbor’s house. Cinderblocks from their corral area littered our lower horse corral. Their “pasture” was filled with sand. Lucky they hadn’t set up the irrigation yet; it would have been destroyed. While I was out one day, workers took the head off the windmill and left it on the ground, at the base of one of the dead trees.

While I was out one day, workers took the head off the windmill and left it on the ground, at the base of one of the dead trees. It’s odd, in a way. I’m the only aircraft charter operator based in Wickenburg. The town has a very nice little airport that recently got a bunch of funding from the Federal Government that added 1000 feet to its runway. But when finally given the opportunity to set up an office on airport property, I turned it down. I, like many other business owners (or potential business owners) here, have learned that

It’s odd, in a way. I’m the only aircraft charter operator based in Wickenburg. The town has a very nice little airport that recently got a bunch of funding from the Federal Government that added 1000 feet to its runway. But when finally given the opportunity to set up an office on airport property, I turned it down. I, like many other business owners (or potential business owners) here, have learned that