It’s a done deal. I’m a land owner!

Back in the summer of 2011, I had a chat with a friend of mine from the east coast about my summer job. I told him him how much I liked the Wenatchee area of Washington where I was working. As he reminded me just the other day, he said to me “Looks like you found your next home.”

I didn’t think much of that idea then. After all, I was married and living in Arizona in a house that would soon be paid off. Although I wanted very badly to move — and even started looking for a new place to live as far back as 2005 — my husband was firmly entrenched in a 9 to 5 grind after bouncing from one dead-end job to another. His only two suggestions for a new place to live — Santa Fe or San Diego — would simply not work for me or my business. So in 2011 I was stuck there in Arizona, waiting for him to wake up and dig himself out of the rut he was living in.

But in the summer of 2012, things were different. First, my husband announced that he wanted a divorce. That got me thinking about a life without having to wait around for him to start living again. Next, I started doing a lot of winery tours, including a flight to a winery along the base of the cliffs in Malaga. The winery was on Cathedral Rock Road, a 2-1/2 mile stretch of winding gravel with 10- and 20-acre residential lots overlooking the Wenatchee Valley and Columbia River. What a nice place to build a hangar home, I thought.

I had a friend who owned land along that road and one day, on a whim, I called him to ask who his Realtor was. I told him I was interested in possibly buying a lot on that road.

“It’s funny you should call right now,” he replied. “My wife and I just decided the other day to sell our lot. Do you want to look at it?”

I did. He described which lot it was and I easily found it from the air. I landed there one day, shut down, and got out to walk around. It was amazing.

On July 5, 2012, I met my friend Don at the lot — we both flew in by helicopter. I wonder what the neighbors thought?

Over the following weeks, I brought other people to see it. My friend Pete. My friend Jim. My friends Don and Johnie. The day I met Don and Johnie there was the same day I flew in with the owners, Forrest and Sharon. We had two helicopters parked on the driveway. Turns out, Don had worked for Forrest’s dad when he was a kid. Small world, huh?

Forrest pointed out the boundaries of the 10-acre parcel. It sat on a shelf on the river (north) side of the road. A hill on the west side shielded it from the homesite on the next lot — which had also belonged to Forrest and Sharon. There were expansive views to the northwest to southeast — 270° — that included the city of Wenatchee, the river, the airport, and countless orchards. To the south were tall basalt cliffs. Although the land sloped down toward the river, at least 80% of it was completely buildable with a minimum amount of earthwork. Electricity, water, and even fiber-optic cable were already at the ideal homesite. Quiet and private, it was exactly the kind of place I like to live without being too far from town. And with friends living just down the road, it was a real win.

But it was the views that got me. I’ve always been a view person.

I knew before the middle of July that I had finally found the place I wanted to make my next home.

The Deal

The sellers told me what they’d planned to ask for the property and agreed to reduce that price for me since a Realtor wasn’t involved. I would, however, have to cover all the closing costs. I did some math and decided that the cost was reasonable and within my means. After all, my husband had told me he wanted a “fair and amicable divorce.” If we couldn’t patch things up when I got home in October — which I still had hopes we could do — I’d take my share of the value of our paid-for house in Wickenburg and apply it to my new home in Malaga.

Of course, this was before my husband got a lawyer and some very bad divorce advice. Before we began the year-long battle to settle. Someone’s idea of “fair” wasn’t very fair at all.

As far as the land deal was concerned, I wouldn’t be able to close until 2013 anyway. The sellers had sold another lot — the one next door — in 2012 and didn’t want two sales in the same year for tax purposes. Even though things on the divorce front looked bad, I figured that my husband would eventually get smart and take my very generous counter proposal.

I was wrong.

The Long Wait Begins

When Christmas came and went and my husband’s lawyer managed to postpone the court date from January to April, I realized I wouldn’t be closing as soon as I’d hoped. The sellers were very patient, though. We chatted once or twice on the phone during the winter. They weren’t in any kind of rush to close the deal.

In January, I flew out to Wenatchee for a week to see what the place was like during the winter months. I was a bit concerned about that big cliff on the south side of the property, knowing that the low sun angle and short winter days that far north could leave the land in complete shadows for days, weeks, or even months at a time. But in January, the lot did get some sunlight. There was snow on the ground that week but the road was passable — even in a rental car. I only got stuck twice and managed to unstick myself both times by myself. Driving up there in the winter would be fine in my Jeep or 4WD truck.

I got to experience the winter fog so many people had told me about. It hung over the river, right about the level of my lot. I went to visit a friend in Wenatchee Heights and got the pleasure of climbing above it, seeing the Wenatchee Valley as a white puffy blanket of clouds beneath the high hills.

I also talked to a builder and a septic system guy.

In late February I returned with a friend. I had to drive my truck up from Arizona to get my avgas fuel tank installed in the truck bed and move my RV down to California for a frost contract. My friend was very impressed with the land and shared my excitement about moving there.

Time moved on. There was a lot of talk on the news about property values recovering. I knew that property values in Washington were already healthier than those in Arizona. I worried that the owners would change their mind about selling or change the price. Several of my friends had already asked me if I had a contract to buy and I admitted I didn’t. I decided I needed to change that.

Fortunately, the sellers lived in Arizona in the winter, not far from my home in Wickenburg. In late March, I drove down to Sun City to meet with them, bringing along a standard real estate sales agreement I’d picked up in a stationery store in Wenatchee when I was last there. We filled out the form and I gave them a check for $5,000 in earnest money. The following week I opened escrow with Pioneer Title Company in Wenatchee. We’d agreed on a closing date on or before June 30, 2013. My birthday.

Financing Woes

Meanwhile, my divorce dragged on. My husband rejected every attempt I made to settle. He apparently thought he could get more if he let the judge decide.

The divorce put a stain on my finances. The legal fees drained my personal savings and began tapping into my business savings — the money I was setting aside for the helicopter’s costly overhaul. I had originally intended to pay cash for the land and finance the building, but now I didn’t even have enough cash for the land. I had to finance it.

And that was the challenge. Everyone told me I should get a construction loan, but no bank wanted to finance the land and building with the type of building I’d decided to build — a pole building with living space. Understand that my first priority was to get storage space for my helicopter, RV, and vehicles; I’d build temporary living quarters above the garage to live in until I could afford to build a “real” house. I did not want to live in my RV year-round. But banks wouldn’t finance that kind of building because they couldn’t get comps for it for appraisal purposes.

In April and May, my future home was covered with huge yellow flowers.

So I decided to finance the land and pay cash for the building. And I found a lender who would not only lend me the money on the land, but offer a great deal on that loan. You see, because of the size and location of the land, it qualified for farm credit. I could get a farm credit loan.

In May 2013 I finally applied for the loan. In the financial information section of the application, I listed all of my personal and business assets except my home — after all, my husband wanted it and would likely get it in the divorce. (I certainly didn’t want it.) Being completely debt-free, I look very good on paper. I was sure I’d get the loan.

But there was a snag: the lender said he could not process the loan until my divorce was finalized. I needed the divorce decree.

Once again, I found myself waiting for my husband.

The Bridge Loan

In late June, when I still didn’t have a divorce decree in hand, the owners agreed to push back the closing date to July 31. I had to cough up another $5,000 for the escrow deposit. That wasn’t a problem. I’d been working on cherry drying contracts since the end of May and had a good cash flow again.

But I was getting worried that the sellers would back out. The real estate agent who had sold the lot next door for them was nagging them about listing the lot they were selling to me. I knew that they’d be able to find another seller pretty quickly, perhaps for even more money.

Meanwhile, the lender had already told me that once they got the divorce decree and a preliminary loan approval, they still had to get an appraisal for the land. That could take three to six weeks. They refused to get the appraisal without preliminary approval, even though I offered to pay for the cost without any guarantee of the loan. The loan simply could not move forward without the decree and even when that piece of paper was produced, I could expect to wait up to two months for the loan to be finalized.

There was no way I could meet a July 31 closing deadline.

I racked my brain for options. As anyone who knows me can tell you, I’m a very resourceful person. But I was coming up empty.

Except for one option.

Early on, the sellers and I had talked about them carrying a loan on the land. I had done this with a condo I sold back in 2008 and it was one of the best deals I’d ever made. Monthly income at a good rate of return — surely two retirees would like that. Yes, they said. But their accountant advised them to not allow me to build on the land until it was paid for in full. Obviously not a workable solution for a long term loan.

But how about short term? Would they be willing to carry it until year-end? By that time I’d surely have the farm credit financing I wanted.

We spoke about it and I was frank about my concerns. They were frank about their Realtor wanting to list the land. They came up with terms I could live with. I requested that I be allowed to put a septic system on the property — the last component I needed to move my RV there — and they agreed. After all, it would increase the value of the property. We went to the title company agent and she drew up papers.

There was only one more requirement: that I get a life insurance policy for the amount of the loan naming the sellers beneficiaries. No problem, I thought.

I was wrong.

The insurance agent informed me that if I got a life insurance policy in the state of Washington I was required by law to list my husband as a beneficiary. While it was true that I could list him for just $1, I had absolutely no intention of listing him on any financial transaction I made. I was told that if I represented myself as an unmarried woman, I would be committing fraud and the policy would be invalid.

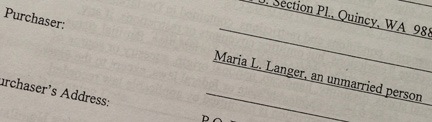

And that made me wonder about how the property would be titled if I closed before the divorce decree was filed with the court. As far as I was concerned, it had to be titled, right from the start, to me as an unmarried woman.

So I had to wait.

Closing

Meanwhile, the sellers came to the title company office and signed all the necessary papers to sell to me and set up the loan. I told the title company that I couldn’t get the insurance as quickly as I expected. (No lie there.)

Yesterday’s blog post goes into a bunch of detail about my wait for the divorce decree. It finally arrived on Tuesday, July 30, a day I now consider Freedom Day, the first day of my new life.

I spent most of Tuesday talking on the phone and exchanging email and texts. There were so many people who wanted to know the outcome, so many people I needed to talk to. It was a good day. I ran my phone battery down three times and got all kinds of good wishes from friends, family members, and even business associates.

But on Wednesday morning, I headed down to the insurance company to get that policy taken care of. It took 30 minutes and $70 to get what I needed. I decided to take it over to the title company, which was nearby, and drop it off.

I’d signed half the papers before I realized I was actually closing on the land deal.

The title company agent was full of congratulations for me. We went into her office where I handed over the insurance paperwork. She pulled out a file and had me start signing papers. I’d signed about four things when I realized something with a start: I was finally closing on the property I’d been trying to acquire for the past year, the property where I planned to build my new home and life.

I voiced this realization and she confirmed it. All she needed was a certified check for my downpayment and a voided check for the automatic loan payments. I handed over the voided check without hesitation, glad that I’d brought along my checkbook, tickled that it included my new physical address as well as my P.O. box mailing address.

It made me very happy to see this line on the closing papers.

Afterward, I went to the bank to get the certified check. I’d already transferred the necessary funds into my personal checking account, so it only took a few minutes. I then drove back to the title company and dropped off the check.

Done.

The deal was filed with the county on Thursday. I’m now the proud owner of 10 acres of view property in Malaga, WA.

Next up: getting a septic system installed, power turned on, water turned on, and bids for my building. You can bet I’ll be pretty darn busy over the next few months.

Of course, in the back of my mind, simmering like a pot of risotto, is knowledge that when I get back to Arizona in October, I’ll have to begin cleaning up the detritus of a 29-year relationship spread among three dwellings and a pair of hangars. I have to negotiate with The Tormentor on who’s keeping what. I know I’ve already lost custody of our dog, Charlie, despite the fact that I think I can give him a better home. Possession, after all, is 9/10ths of the law. But what else will I get — or be stuck with? And how much can I sell or throw away? And what will I do with my stuff until I land on my feet elsewhere?

Of course, in the back of my mind, simmering like a pot of risotto, is knowledge that when I get back to Arizona in October, I’ll have to begin cleaning up the detritus of a 29-year relationship spread among three dwellings and a pair of hangars. I have to negotiate with The Tormentor on who’s keeping what. I know I’ve already lost custody of our dog, Charlie, despite the fact that I think I can give him a better home. Possession, after all, is 9/10ths of the law. But what else will I get — or be stuck with? And how much can I sell or throw away? And what will I do with my stuff until I land on my feet elsewhere? This time around, the book’s revision needed to be done in the summer. Not a big deal;

This time around, the book’s revision needed to be done in the summer. Not a big deal;  For the first time ever, I had enough cherry drying standby contract work to bring on two more pilots. One worked with me for 25 days; the other worked with me for just 9 days, during “crunch time.”

For the first time ever, I had enough cherry drying standby contract work to bring on two more pilots. One worked with me for 25 days; the other worked with me for just 9 days, during “crunch time.” The busiest time for cherry drying pilots in the Quincy/Wenatchee area is from the beginning of the third week in June to the end of the third week in July. About five weeks.

The busiest time for cherry drying pilots in the Quincy/Wenatchee area is from the beginning of the third week in June to the end of the third week in July. About five weeks. And that’s not all. I also got a good charter client who has me fly him and others around to various locations around the state. He likes the helicopter’s off-airport landing capabilities because it saves him time over driving or using the company airplane. I did a bunch of flying for them, too.

And that’s not all. I also got a good charter client who has me fly him and others around to various locations around the state. He likes the helicopter’s off-airport landing capabilities because it saves him time over driving or using the company airplane. I did a bunch of flying for them, too. One of the very good things about my late season contract is where I get to live while I’m working: at the edge of a cliff near the top of a canyon with an amazing view. I never get tired of watching

One of the very good things about my late season contract is where I get to live while I’m working: at the edge of a cliff near the top of a canyon with an amazing view. I never get tired of watching  This year, my helicopter is parked on the property about 50 yards from the back of my RV. I can clearly see it out my back window.

This year, my helicopter is parked on the property about 50 yards from the back of my RV. I can clearly see it out my back window. In the evening, when it cools down, Penny the Dog and I go for a walk in the orchard. One of the owners told me I could pick their cherries and blueberries. Although fruit is not on my diet — more on that in a moment — I simply cannot resist fresh picked cherries or blueberries. So Penny and I go in with a plastic quart-sized container. We pick the small red cherries and yellow rainier cherries, which have very little market value but still taste great. And we finish up by walking down a row of blueberry bushes and picking the dark blue ones. The whole time, Penny is running around in the tall grass beneath the trees or avoiding the sprinklers or finding dead rodents to eat (don’t ask). And I’m getting a workout, climbing hills and sweating in the residual heat.

In the evening, when it cools down, Penny the Dog and I go for a walk in the orchard. One of the owners told me I could pick their cherries and blueberries. Although fruit is not on my diet — more on that in a moment — I simply cannot resist fresh picked cherries or blueberries. So Penny and I go in with a plastic quart-sized container. We pick the small red cherries and yellow rainier cherries, which have very little market value but still taste great. And we finish up by walking down a row of blueberry bushes and picking the dark blue ones. The whole time, Penny is running around in the tall grass beneath the trees or avoiding the sprinklers or finding dead rodents to eat (don’t ask). And I’m getting a workout, climbing hills and sweating in the residual heat.  We get back and I clean up the fruit and hit the shower. Then I spend the rest of the evening taking it easy — maybe sitting outside in the gathering dusk or watching something on one of the mobile mansion’s two TVs.

We get back and I clean up the fruit and hit the shower. Then I spend the rest of the evening taking it easy — maybe sitting outside in the gathering dusk or watching something on one of the mobile mansion’s two TVs. When I arrived in Washington I started exercising again and trying to watch what I ate. But when my pilot friend Mike came up with his helicopter for the 25 days he’d work with me, he told me about how he’d lost 80 pounds on Medifast. His wife had lost 70 pounds. I only needed to lose 35 pounds to get back to my goal weight — which is what I weighed in this photo from 2004. When my pilot friend Jim signed on, I did the same.

When I arrived in Washington I started exercising again and trying to watch what I ate. But when my pilot friend Mike came up with his helicopter for the 25 days he’d work with me, he told me about how he’d lost 80 pounds on Medifast. His wife had lost 70 pounds. I only needed to lose 35 pounds to get back to my goal weight — which is what I weighed in this photo from 2004. When my pilot friend Jim signed on, I did the same.