Too many people are playing this game. I played along to see what it was all about.

Last week, I re-listed my RV, the Mobile Mansion, on Craigslist. I decided I didn’t want to deal with email responses, so I listed my phone number, which happens to be for my cell phone.

The first text message I got about the camper.

The text messages started coming almost immediately. The first wasn’t too odd — except that the person texting me wanted me to reply via email, claiming she wasn’t contacting me from her cell phone. Huh? But I didn’t want a long, drawn out email discussion. So I replied that she should call me.

I never heard back from her.

By the time the second text message arrived the next day, followed almost immediately by another one with nearly the same wording, I knew something was up. (I was born at night, but it wasn’t last night.)

Here’s the one I decided to investigate. It started off pretty weird:

BUYER: Good Day,i searched on CL and saw your< 2010 Keystone Montana Mountaineer 324RLQ - $29900 (Malaga, WA) >which i highly have interest to purchase from you now kindly let me know if it’s available and in Good Conditions ?

Note the deplorable English. It reeked of scam. I played along:

ME: It’s still available. It’s in very good condition. If you want to discuss it, call me.

The response came nearly 12 hours later at 10:11 PM:

BUYER: Sound excellently to me I am from Yakima WA how i wish to come over and view it in person but am currently out of town right now.I work as a Marine Engineer busy sailing on ship right now in U.S naval base.I’m really satisfied with the conditions about it,please kindly text me your actual price that you’re selling it for me ??

Yeah. He’s sailing on a ship in a U.S. naval base. I believe that. I decided to stick to my asking price, figuring that a real person would try to bargain:

ME: $29,900

If there was any lingering doubt about this being a scam, it disappeared with his response:

SCAMMER: Okay i have agree with the price of $29,900 and would have love to pay you via cash but am not around at the moment and i have no one to send to you that’s why i choose Paypal cos its safe,reliable and guarantee transaction safety of funds…so I will want you to get back to me asap with your Paypal email address so that i can proceed with the payment and you will be notify by the Paypal customer care immediately the payment is made and My Mover will be there to pick up and sign all necessary papers as soon as I make the payment …thanks for your consideration.Await your Response

So this guy is supposedly going to send me $29,900 via PayPal and “PayPal Customer Care” will notify me when the payment arrives. Without any paperwork. I don’t even have a name for the guy. I decided to see how far I could string him along.

ME: Don’t you want to see it?

Apparently not.

SCAMMER: In order to enable me to proceed with the payment could you please provide me with the following information below :

Your Full Name:

PayPal Email address:

once i receive the details i will go ahead with the payment and then i will contact my shipping agent for pick up

am okay with it that is why the pickup agent company will contact you for the pick up after payment is made and cleared and take care of the necessary paperwork for the registration after you get the payment. I will need your home address for the Picked

I should mention here that his text messages appeared in 160-character max segments that didn’t always arrive in the correct order. I had to jumble them around to figure out what he was saying. I’m not even sure I got the above quote right.

ME: I think you should see it first. Or do you trust your shipper to inspect it for you?

I heard nothing for nearly 24 hours and figured that he’d realized I knew I was being scammed. I decided to poke him a bit:

ME: I have another person interested but only offering $28,000. Do you still want it? I haven’t heard from you.

Eight hours later, he replied:

SCAMMER: are u there

i am interested have been wating for you to get back to me with your paypal email address and your full name so i can go ahead to make the payment

I made him wait two hours before replying:

ME: I’m not comfortable selling to you sight unseen. I am willing to deliver to you at no cost.

You can give me a deposit on PayPal and pay the rest in cash when I deliver.

A real buyer would be an idiot to turn down an offer like that. But he wasn’t really interested in buying. He just wanted my name and email address to continue his scam.

SCAMMER: PayPal is one of the best ways to make a payment online simply because it’s fast, easy, secure and reliable.

ME: Not as reliable as cash.

And I’m willing to deliver for free. That’ll save you a lot of money!

He replied 28 hours later:

SCAMMER: dont worry about that am okay with it and dis is not my first using them okay

all you do is to get back to me with your paypal email address and your full name so i can go ahead to make the payment right away thanks ‘

At this point, I knew I wasn’t going to get any farther with him unless I gave him what he wanted. But I also wanted to see what he’d say when I insisted on a deposit and cash on delivery. I waited until the next morning before I replied with a fake name and a throwaway email address:

ME: Send me a $2000 deposit. I’ll deliver it to you or someone you designate to accept it. He can inspect it and give me $27,000 cash. Maria Sarducci, zip98828@gmail.com. Be sure to send me delivery info.

Sarducci? Like Father Guido?

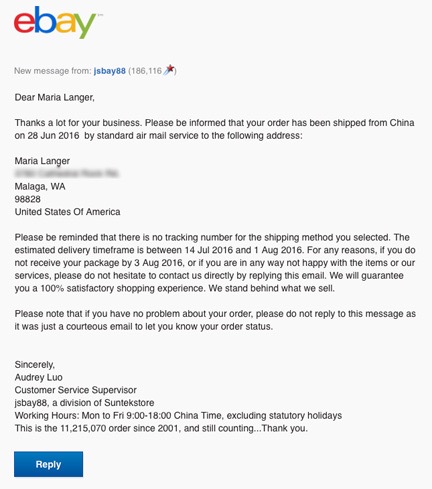

What idiot would actually believe this message came from PayPal?

Less than an hour later, the next part of his plot arrived in the form of another text message from a toll-free number. I have to say that I wasn’t surprised. I expected to hear from “PayPal,” although I did expect it to arrive as an email message. I also expected the message to include a link which I had no intention of clicking.

The way I saw it, the link could do one or both of two things:

- It could run an app that somehow installed malware on my computer. That malware could do any number of things that would make me unhappy.

- It could take me to a page that looked like a real PayPal page and prompt me to enter my PayPal user ID and password. They’d then have access to my PayPal account, which could be catastrophic — if I had a PayPal account with that address.

So the scammer had played his hand: a link supposedly from PayPal that I was supposed to click to get my money. How many people fall for this crap every day? I bet it’s quite a few — over the past week I received text messages from five different phone numbers that were likely going to lead me thought this same script. It must work if they keep doing it.

I decided to pretend I’d never gotten the text message from “PayPal.” I waited until that afternoon and sent another message:

ME: Did you send the $2000 deposit? That other buyer called. If I don’t get the deposit by tomorrow, I’ll have to sell to him.

This morning, I added:

ME: Hello? I’m still waiting for the deposit. You seemed so anxious to buy. What are you waiting for now?

I don’t really expect a response. I suspect he’ll either give up. But if he does respond, it’ll likely be to draw my attention to the text message from PayPal. If he does respond, I’ll tell him I haven’t seen any money come into my account. That should chase him off.

But I don’t expect to hear from him at all again. I suspect he’s got a few suckers on the line — or people like me who are playing him for fun — to keep him busy.

Why did I blog this? I just want people to understand that there are scammers out there and they will rip you off if you’re not aware of the possibility of a scam. When someone texts you and agrees to pay full price for an expensive item you’ve listed online, sight unseen, alarm bells should ring.

This isn’t the first time someone tried to scam me when I was selling a high-priced item. I’d listed my old R22 helicopter for $110K back in 2004 when a scammer tried to con me. You can read about that here.

Don’t be an idiot. If it’s too good to be true, it probably isn’t true.

—

April 19 Update: I got another message from a different toll-free number this morning. Actually, two identical messages arriving about 30 seconds apart:

You have 2 new messages for 2010 Keystone Montana Mountaineer 324RLQ Fifth Wheel : 15096998044.accmobusr.com/clrv1

Same domain, different link. In the meantime, I wrote back to the scammer:

ME: I’m still waiting to hear from you. The money did not arrive in my PayPal account. If you’re not interested anymore, kindly have the courtesy to tell me.

Again, I don’t expect a response. But if I get one, I’ll update this blog post.

Scammers/Spammers will say and do anything. Here’s proof.

Scammers/Spammers will say and do anything. Here’s proof.

Here’s the floor plan for my mobile mansion.

Here’s the floor plan for my mobile mansion.