A few thoughts about the use of “elite” as some sort of slur.

The other day, I was accused by a troll on Twitter of being part of the “rich elite” because I owned a helicopter and went south for the winter.

I think I was supposed to be insulted. I wasn’t. You see, I’m not ashamed of what I am or what I do with my time and money. I earned all of my possessions and my lifestyle.

Don’t believe me? Read on.

The only things I had going for me at birth was that I was born in the United States, I was white, and I had a good brain.

My parents were not rich. In fact, when my father left us when I was about 13, my mother very nearly applied for welfare. Our financial situation qualified me for free lunch at school; every day, I’d go to the school office and retrieve a small kraft envelope with 65¢ in it — government money to pay for my cafeteria lunch. I’d spend as little as possible and save the rest. When I got home from school, I babysat my younger sister and baby brother while my mother worked as a waitress to put food — mostly hot dogs and pasta — on the table. My grandmother would bring us groceries once in a while and slip my mother a $20 bill to help out.

I started working at age 13 when I got a paper route. I delivered the Bergen Evening Record after school on weekdays and the Sunday Record before 7 AM on Sundays. There were 54 homes on my route, which I had to walk, and I netted 20¢ plus tips per week per house. In those days — the mid 1970s — 10¢ was considered a generous tip; many of the homes did not tip at all. Collection day — Wednesday — was unusually long since I had to stop at every single house to try to get paid. One Wednesday in September, which coincided with the first day of school, my mother used my collection money to pay for our school supplies because she wouldn’t have money until payday.

Our financial situation qualified me for a summer job working at the high school. With three other girls, all a year or two older than me, I scraped rust off an old chain link fence that ran between the school property and the railroad tracks. The wire brushes we used had to be replaced every few days because the bristles would fall out. The gloves they gave us did little to prevent huge blisters on our hands. When it rained, they let us into the school where we went from classroom to classroom, washing the venetian blinds. The wash water had to be changed every 30 minutes or so because the blinds had likely never been cleaned before.

My mother remarried and I won’t deny that my blue collar stepfather brought us quite a few steps up from our dismal financial situation. I got a chance to see some of the better things in life. He took us to museums and restaurants with real cloth napkins. I stayed in a hotel for the first time in my life at age 15. I was even able to accompany my grandparents on a trip to visit family in Germany. And, for the first time, I started thinking about college.

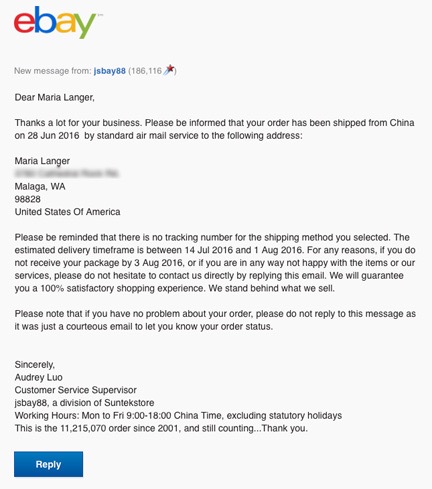

College was possible with two academic achievement scholarships, financial contributions from my parents (they each paid 1/3 of the net after scholarships were deducted from tuition), and a school loan. And work. At one point I held down three part-time jobs while handling a 15 or 18 credit load. I worked hard to maintain good grades and got a BBA with highest honors in Accounting in four years. I was the first person in my family to attend and graduate from college.

Within two weeks of graduation, I got my own apartment. I paid rent and utilities and furnished it with my own money. It was in a rough neighborhood and a few of my friends didn’t like to come visit. My mother bought me a sewing machine as a graduation gift and I used it to make about half the clothes that I wore to work, so I could look nice without spending a fortune.

I started my first job right away: an auditor with the New York City Comptrollers Office. In just two years, at the age of 22, I became the youngest person promoted to Field Audit Supervisor. After five years with the city, I started a new job with ADP in New Jersey. I did my time in the Audit Department before becoming a Senior Financial Analyst working on special projects directly for the CFO.

By the age of 29, I was earning more money per year than my father ever had. But that didn’t stop me from leaving my job to pursue an uncertain career that was more in line with what I wanted to do for a living: write. I built a career as a tech writer and computer trainer from the ground up. I was completely self-taught and worked without an agent. I wrote books and led hands-on computer training classes all over the country. I quickly learned that I needed to write a lot of books to make a living so that’s what I did. When I was on a book project, I’d work 10-12 hour days, 7 days a week. I wrote books and articles and eventually authored video training courses. I was very good at what I did and it paid off: within 10 years, I had two bestsellers; their periodic revisions were bestsellers, too.

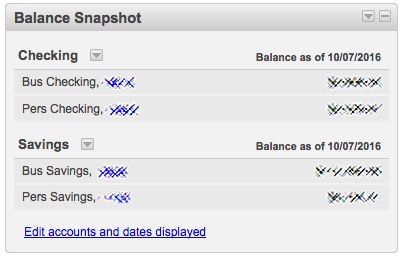

By the age of 40, I was earning more money than I’d ever thought possible, but instead of pissing it away on a bigger house or fancier car, I socked money away for retirement and invested in rental properties: a condo, a house, a small apartment building. And between book projects, I learned how to fly helicopters.

And yes, I did buy a helicopter. Why not? It was my money that I had earned through my efforts. I had covered all my other financial responsibilities and set aside enough money for my future. Why shouldn’t I invest in something that would make me happy?

I flew as often as I could and started a helicopter business to help bring in some extra revenue to cover costs. I managed the fuel concession at the local airport. I became an aeronautical chart dealer and ran a small pilot shop. I worked for a season as a pilot for a Grand Canyon tour operator. I sold that first helicopter and bought a slightly larger one. I jumped through hoops with the FAA to get required certifications for charter work. I created advertising material, maintained a website, handled social networking needs, did all the accounting, met with clients, did local and long distance flights. I networked with other pilots about other flying jobs.

All while still writing up to 10 books and dozens of articles a year for my publishers.

When tech publishing went into decline, I ramped up my flying work. I got contracts to do agricultural work in Washington state during the summer. I’d live in a trailer, working on various book projects, waiting for a call to fly, for two to three months every summer. Over the years, I built up the number of contracts I had until I couldn’t handle them all alone; then I brought in other pilots with helicopters to help me, managing work and billing for as many as four subcontactors every season.

I was 52 when the man I’d spent more than half my life with decided he needed a mommy to hold his hand while he watched TV every night more than a life partner to actually enjoy life with. He tried to take half of everything I owned in our divorce, but I fought back to keep what was rightfully mine, what I’d earned through my own efforts while he floundered, failing at one job after another. I went into the fight with a war chest of cash I’d saved while he was pissing his money away on a plane he never flew, a Mercedes he didn’t need, and a condo that was sucking him dry financially. His greed, harassment, and courtroom lies didn’t score many points with the judge and he wound up paying me and his lawyers far more than he could have spent if he’d settled for my offer. His downfall is a great example of someone getting what he deserves.

I’ve spent the last four and a half years rebuilding my life in a new place, working hard to build my flying business, expanding into other work in California and now possibly Arizona. I don’t write much anymore, but I make a good living with the helicopter the Twitter troll I mentioned at the top of this piece criticized. I’ve learned how to take my skills and assets and turn them into money. And unlike so many other people, I live within my means. Yes, I go south for the winter, but it’s not as if I’m living it up in some fancy condo or hotel. I’m roughing it in an RV often parked out in the desert.

Just about everything I own was bought and paid for with money that I earned through my efforts. Why shouldn’t I be proud of that?

I worked hard and smart and I succeeded. Is there any reason I should be ashamed of that?

So yeah, if making a good living and owning a helicopter and wintering in the south makes me part of the “rich elite,” I’m okay with that. I earned it.

And to the people who troll me with their jealousy-driven comments: What’s your excuse for being a loser?