My new morning routine.

A shot looking west up the canal from the first bridge.

The second bridge is exactly 1.3 miles from my RV.

I walk for about a half mile alongside this apple orchard. This morning, I saw three woodchucks in rocks like these along the canal edge.

Last week, I began walking regularly. It’s part — the only part, I should admit — of an exercise regime. I know it’s not much, but it’s more than I was doing the week before.

I usually get out between 6:30 and 7:00 AM, when it’s still nice and cool. I’m back within 45 minutes.

I should be clear here: I don’t go for a short stroll. I walk 2.6 miles at an average speed of 3.6 miles per hour. How do I know this so precisely? Simple: I monitor my progress using the trip computer on my handheld GPS.

(While other people are relying on a touch-screen GPS with computerized voice to find their way around town, I use my GPSes for things I can’t easily do on my own. But let’s not go there, huh? That’s fodder for a whole other blog post.)

I took the photos you see here on this morning’s walk. The pauses brought my average speed down to 3.3 miles per hour.

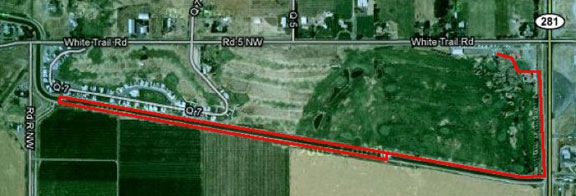

I start at my RV at Colockum Ridge Golf Course. I cut through the golf cart staging area and past the maintenance shed. That puts me on a two-track gravel road between a narrow drainage ditch full of clear-running water and the golf course. I walk about .3 miles south, then make a right onto another gravel road that runs along the north side of a canal. If I’m lazy, I cross the canal at the first bridge and come back along the other side for a 1.2 mile walk. But if I’m serious about exercise, I continue to the second bridge. The whole time, I’m walking alongside the golf course and then the 55+ trailer community beyond it. When I cross the second bridge, I walk back along the south side of the canal with an apple orchard and then an alfalfa field on my right. I cross back over the first bridge and retrace my route back to my RV.

Here’s what it looks like in satellite view on Google Maps:

These aren’t the little wimpy alfalfa bales we bought for our horses. These probably weigh 500 pounds each and stand nearly as tall as me.

A view of the golf course from the opposite side of the canal.

I really enjoy the scenery. I love the changes in the farmland. Yesterday, the alfalfa was cut and piled. Today it was baled. The apples are ripening. Some farm equipment off in the distance was harvesting soybeans or something. The groundhogs are kind of cute.

3.6 miles per hour is a good walking pace. It’s probably the pace I used regularly when I walked the streets of New York. If you don’t walk fast in Manhattan, you get run over by other pedestrians or messengers on bikes or guys pushing racks of clothing. (I spent a bunch of time in the garment district one summer.) I’d like to get my walking speed up to 4 miles per hour, but it would likely kill me.

I listen to music when I walk. I have a little iPad shuffle and keep it stocked with an ever-changing mix of my favorite music. I discovered the other day that my walking pace is at the same tempo as Paul Simon’s “Late in the Evening.” I have long legs so I have long strides. I feel it in my knees and hips.

When I get back to the trailer, I’m sweating like a pig. (Do pigs really sweat?) I force myself to drink water or vitamin water before jumping in the shower. When I’m that hot and sweaty, the shower feels like heaven and makes the walk worthwhile. Afterwards, I have breakfast: high fiber cereal with fresh berries and low-fat milk. I have coffee before the walk — I am human, after all.

According to the Walking Calories Calculator on About.com, I burn at least 259 calories each time I do my walk. That’s not very much, but it is better than nothing. I’m hoping the regular brisk walk will also help me recover some of my muscle tone, which is quickly melting away.

I’m middle-aged now, and I’m not going down without a fight.