I’m surprised to learn that applying for an MMSI number for my boat with the FCC is a lot quicker and easier than I thought.

I’m currently on the home stretch for adding AIS transmit capabilities to my boat and I thought I’d share what I’ve been going through, along with instructions for getting an MMSI number from the FCC. If all you care about are the instructions for applying for the number, skip ahead to the section titled “Applying for an MMSI with the FCC” below.

AIS on My Boat Explained

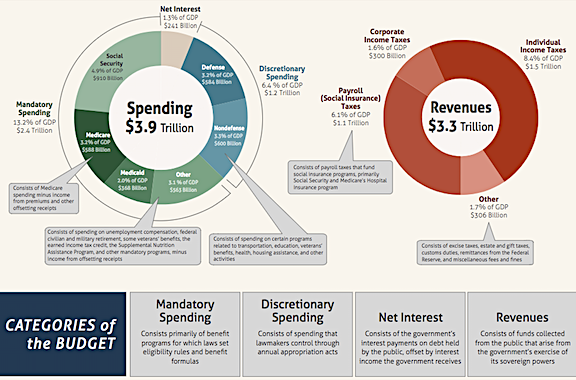

My boat’s navigation Garmin navigation and communication components — specifically, it’s VHF radio and chartplotters (with GPS) — are compatible with the AIS system for tracking boats. Here’s what Wikipedia has to say about this system (edited for length):

The automatic identification system (AIS) is an automatic tracking system that uses transceivers on ships and is used by vessel traffic services (VTS). … AIS information supplements marine radar, which continues to be the primary method of collision avoidance for water transport. Although technically and operationally distinct, the ADS-B system is analogous to AIS and performs a similar function for aircraft.

Information provided by AIS equipment, such as unique identification, position, course, and speed, can be displayed on a screen or an electronic chart display and information system (ECDIS). AIS is intended to assist a vessel’s watchstanding officers and allow maritime authorities to track and monitor vessel movements. AIS integrates a standardized VHF transceiver with a positioning system such as a Global Positioning System receiver, with other electronic navigation sensors, such as a gyrocompass or rate of turn indicator. Vessels fitted with AIS transceivers can be tracked by AIS base stations located along coast lines or, when out of range of terrestrial networks, through a growing number of satellites that are fitted with special AIS receivers which are capable of deconflicting a large number of signatures.

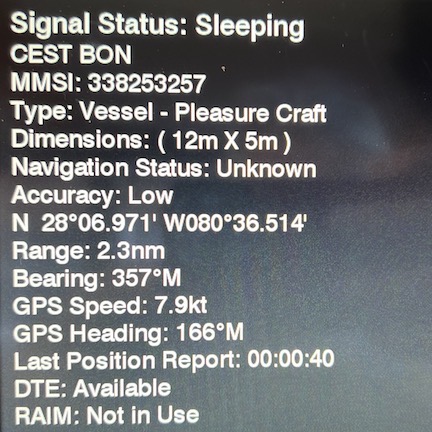

The AIS target appears as a triangle pointing in the direction of travel (top). Tapping the target on the chartplotter screen displays the name of the vessel (middle). Tapping other buttons eventually displays info screens for the target that include the vessel name, direction of travel, and speed (bottom). In most cases, there’s a second page screen with more info. Note that most of the statuses say “Sleeping” at the top; I still don’t know why.

What all this means is that AIS enables vessels to be tracked by ground- and vessel-based stations. The way it currently works on my boat is that my VHF radio includes an AIS receiver which gathers the data and sends it to my chartplotters, where those signals are plotted. AIS targets appear as little triangles pointing in the direction of travel. I can tap a triangle to get information about the target, including vessel name, type, speed, direction, and time to intercept (if applicable).

If you’ve been reading my Great Loop blog, you should have an idea of how helpful this has been when traveling among large commercial boats such as tugboats with barges (referred to as tows). I can see them on screen before I see them with my eyes and I can make radio calls to them by name to arrange for passing, etc.

The trouble is, my boat does not transmit my information to the AIS system. That means that my boat remains invisible to others on their chartplotters. I can see tows but they can’t see me.

(I should mention here that this is exactly opposite to the requirements of ADS-B systems on US-based aircraft, which are required to transmit (ADS-B Out) but not receive (ADS-B In). Of course, no part of the AIS system is currently required at all on a boat of my size and type.)

Lots of folks might think it’s a good thing that I’m invisible to the AIS system. Privacy, etc. [Insert eyeroll emoji here.] But I want to be seen by other, especially larger, vessels. I want to appear on their systems just like they appear on mine so they can reach out and talk to me if they need to.

And thus the challenge of adding this feature to my system began.

Getting the Numbers

The one component you must have to set up an AIS transmit feature on a boat is an MMSI number. Here’s another Wikipedia explanation for you:

A Maritime Mobile Service Identity (MMSI) is effectively a maritime object’s international maritime telephone number, a temporarily assigned UID, issued by that object’s current flag state (unlike an IMO, which is a global forever UID).

An MMSI comprises a series of nine digits, consisting of three Maritime Identification Digits (country-codes), concatenated with a specific identifier. Whenever an object is re-flagged, a new MMSI must be assigned.

My boat, Do It Now, is a “maritime object.”

(If you’re interested in a more gov-speak description, here’s more on the FCC website.)

You can get an MMSI number two ways — but wait. I’m getting ahead of myself here.

Before you can get an MMSI number, you need to have a Coast Guard documentation number, referred to by the Coast Guard as the vessel’s Official Number (O/N). It’s a 6 or 7 digit number assigned to the vessel at the time it is first documented with the US Coast Guard. This number remains with the vessel indefinitely and must be permanently affixed to the vessel in accordance with a bunch of rules we don’t need to go into here.

Coast Guard documentation is not required for a boat like mine. The previous owner, in fact, opted to skip documentation and simply register the boat with the state of Washington. That gave the boat a WN number which appeared with a registration sticker on boat sides of the bow. When I bought the boat, it was registered in my name so I believe that as far as the state of Washington is concerned, it’s still registered with that number. But when a boat is documented with the Coast Guard, that number is not used — in fact, it must be removed from the boat. Instead, the name and hailing port of the boat must be affixed to it in accordance with a bunch of rules that, again, we don’t need to go into here.

When a bought the boat, the title company handling the transaction — and yes, when you buy a boat like mine, a title company does get involved — handled my application for documentation. I was warned that it could take several months. Until then, I had my application for the number — in case the Coast Guard or anyone else needed to see it — and I could remove the WN number and put my boat name on the boat. I did that in November in Alton, IL. It seemed like a major step forward.

When I went home for three weeks in November, there was nothing from the Coast Guard waiting for me. Since then, I’ve had my house sitter check my mail regularly. In late January, he found a thick letter from the title company. The Coast Guard documentation was in it. He forwarded my mail and I finally got my hands on the Official Number in early February.

Yes, it had taken the Coast Guard a five full months to process the title company’s request on my behalf.

So that hurdle had been jumped. (I’m now in the process for getting the number affixed on the boat in a way that satisfies Coast Guard requirements.)

Back to the MMSI number… I mentioned that there were two ways to get this number.

One way, which I was told was the “easy way” was to apply through an organization such as Boat US, which had an online form. Everyone I asked told me to do this. But those same people didn’t read the fine print on the page:

BoatUS has been authorized by both the Federal Communications Commission (FCC) and the U.S. Coast Guard to assign MMSI numbers only to vessels that meet the following criteria:

- Used for recreation only

- Not required by law to carry a radio

- Not required by law to have a FCC Ship Station license

- Vessel is under 65′ in length

- Do not communicate with or visit foreign ports (i.e. Canada, Bahamas, Mexico, and the Caribbean)

If you do not meet these criteria, you are legally required to obtain a Ship Station License from the FCC. They will issue an MMSI number with a Ship Station License.

It’s that fifth point that makes getting an MMSI through BoatUS impossible for me. You see, I have every intention of taking my boat to foreign ports — Canada and perhaps the Bahamas. So I must go through the FCC to get my boat’s MMSI number. (Also, I have to wonder why anyone would lock their boat to an MMSI number that didn’t allow overseas travel/communication. Getting an MMSI through the FCC obviously increases the market value of the boat; it’s ready for anything.)

Applying for an MMSI with the FCC

And that’s where the trouble began. You see, the FCC’s website is a typical US Government website, obviously designed by the lowest bidder whose job is to make it work — not make it work well or intuitively. It is confusing — far more confusing than it needs to be. And despite my years in tech, I struggled with it.

I knew — from extensive Googling — that I needed to fill out form 605. Specifically, according to the FCC:

In order to obtain a new MMSI number, please indicate that you wish to be assigned a new number in Question 11 of FCC Form 605, Schedule B.

I tracked down Form 605 and was able to download it as a PDF. Trouble is, it must be filed electronically. That means I had to do it online. And when I followed the link for filing forms online, I reached my next hurdle: I had to register with the FCC to obtain an FCC Registration Number (FRN).

I clicked the link to do that. I filled out a form. Eventually, I got a login that included an FRN.

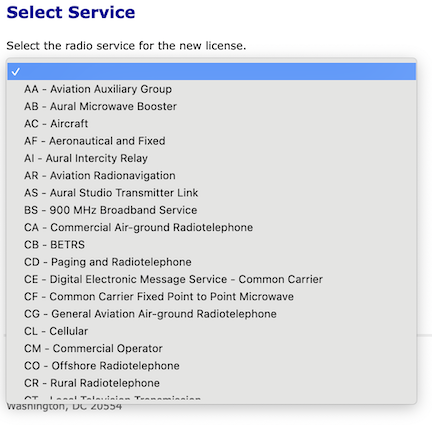

You have to know which service to pick to use the wizard.

I logged into my new FCC account. I clicked a link to Apply for a New License. And that’s when everything went off the rails. You see, the FCC doesn’t just give you a list of forms you can fill in online — even after telling you exactly which form and line on the form you needed to complete! Instead, it displays the first page of an extremely poorly designed “wizard” that begins by asking you to “Select the radio service for the new license.” The pop-up menu includes dozens of options, several of which seem to relate to marine use. There is no guidance telling you which one to pick for an MMSI number. If you choose the wrong one, you don’t know it until you’ve filled out the form and realized that they never asked for the appropriate information. Then you have to start all over again with a different option. (Ask me how I know this.)

I’ll save you the bother of trying to figure it out for yourself (as I had to). The option you want is SA or SB – Ship.

I then worked my way through the “wizard” to answer questions. Eventually, I had to enter that Coast Guard Official Number (the documentation number). I also had to enter my boat’s name and some other information. Finally, I was done and was able to add my application to a sort of cart for payment. The fee was $185.

Even paying the fee wasn’t intuitive. I had to go to a payment system and then provide my FRN and select the item I was paying for. They take credit cards, so it was easy enough to pay. Finally, I submitted the form.

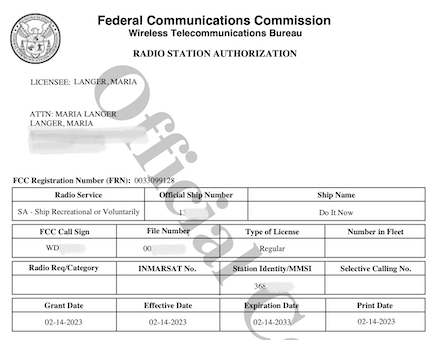

I did all this on a Sunday. I wondered how long it would take to process my application and whether the paperwork would arrive in the mail and how soon I’d have to start asking my house sitter to start looking for a letter from the FCC.

The FCC might have a crappy website, but it does have quick turnaround on applications.

But on Tuesday morning — yes, just yesterday — I got confirmation in the mail that my application had been accepted. The message contained a link and when I clicked it, my computer downloaded a PDF of the paperwork. So yes, once I’d figured it out, I had my MMSI within 48 hours of applying for it.

Next Steps

Garmin’s Blackbox has no interface. I hope it’s small; my electronics cabinet is very full.

If you recall, the whole purpose of getting the MMSI number was so that I could set up my boat for AIS transmit. Unfortunately, that’s also going to require additional equipment, specifically the Garmin AIS 800 Blackbox Transceiver. Although Garmin frustrates the crap out of me and I hate giving them my money, this is the “easy” way to get my boat set up to transmit AIS.

I was told by the General Manager at Pocket Yachts in Jensen Beach, FL — last Monday’s stop — that the best way to get this was to order it from West Marine and have it shipped to wherever I was going to have it installed. West Marine would program my MMSI number into it for me so as long as the installer knew what he was doing, it should work as soon as it’s powered up.

Today I’m in Melbourne, FL and there’s a West Marine a bike ride away. If they can do the programming in the store, I’ll buy it and take it with me. (I have a bunch of credits at West Marine that should bring down the price significantly.) If they can’t program it, I’ll figure out where I’ll have it installed and have it shipped there. I’ll be in Titusville, St. Augustine, and Jacksonville over the coming weeks; one of those places must have a Garmin installer nearby.

That should be the last hurdle to get this done. We’ll see.